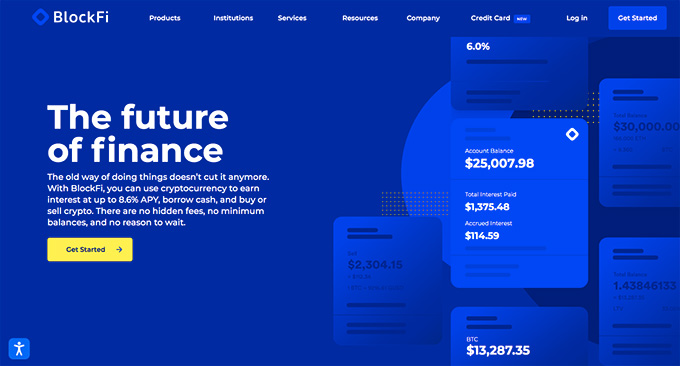

These days, there are various cryptocurrency services available to be used to your advantage. Exchanges, wallets, loan providers, yield farms, and many more – there are many things that you can do with your crypto assets! If you’re not comfortable transferring your cryptocurrencies all over the place, though, this BlockFi review might offer the perfect solution to you.

BlockFi is one of the more-interesting crypto platforms on the internet. It acts as a platform that offers multiple different crypto-related services in one place. That is definitely convenient, and voids any possibility of mishandling your assets due to there being too many different services that would need to be managed at the same time.

That is only the case if BlockFi is legitimate, though. Whether or not that’s the case is something that we’ll try to figure out right here, in this BlockFi review! Well, THAT, and a lot of other, related things, too. At the very end, I’ll also show you how to register on BlockFi, too – stick around!

BlockFi Review: PROS

We’ll start our BlockFi review by discussing some of the main benefits that you can expect to receive while using the platform in question. Addressing the elephant in the room straight from the get-go, the very first things that we’d need to check out are the actual core features that BlockFi offers to its users.

A Commission-Free Cryptocurrency Exchange Service

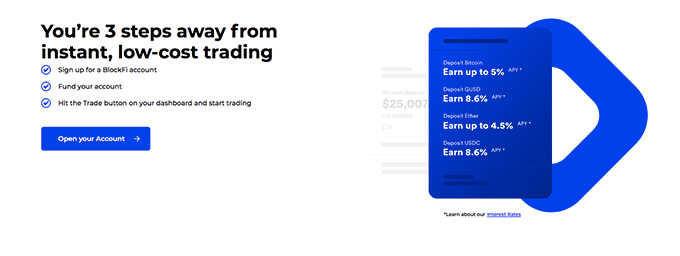

Obviously, one of the core aspects of the BlockFi crypto platform is that it can act as an exchange service. Not any exchange service, though, but a completely fee-less one, at that!

That’s right – probably the core feature that makes the platform stand out of the exchange and brokerage crowds is the fact that there are no BlockFi fees. You can trade to your heart’s content, without worrying that potential fees are going to dig into your profits. There is still a spread, sure, but that’s to be expected.

This is actually much more significant than it might appear, at first glance.

The vast majority of the top-rated cryptocurrency exchanges out there are going to have some sort of a fee model in place. The standard fees range anywhere from 0,1% up to 4% – naturally, the latter would be considered very high.

That aside, though, the fact that there are no BlockFi fees in place means that you retain all of the profits made from a successful trade. Some cryptocurrency exchanges do like to have hidden fees – ones that only become apparent once you’ve already registered and deposited crypto on the platform.

Yet again, not the case with BlockFi – multiple user BlockFi reviews will tell you that there are no hidden fees on the platform, either.

All things considered, as far as the exchange part of the service is concerned, the fact that the BlockFi fees are non-existent is surely one of the main selling and attraction points for the company in question. It’s not the only one, though – once you’ve finished trading, and, say, decided to keep your cryptocurrency assets on the platform in question, you can actually earn interest on your coins.

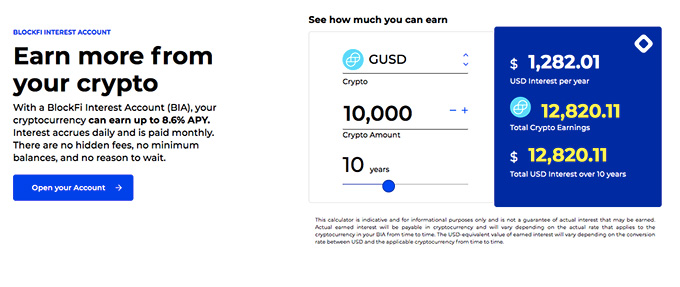

Compounding Interest Accounts

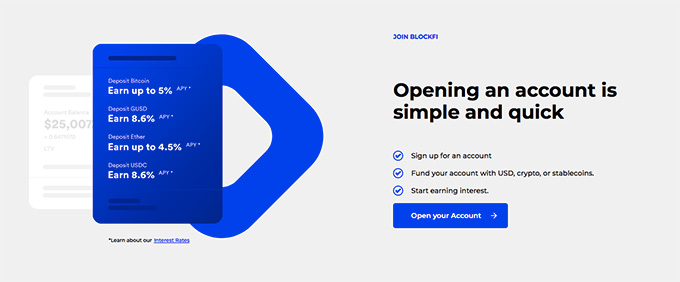

Truth be told, BlockFi interest rates are probably the main feature for which BlockFi is known for, in the first place.

To put it very shortly, many user BlockFi reviews talk about the fact that you can earn interest on your crypto tokens by simply keeping them in your BlockFi account. That is, for a fact, completely true.

The process is as painless as it sounds, too – all you need to do is register on the platform, transfer the cryptocurrency of your choice, and that’s it! Once the coins are on your account, you will be able to earn BlockFi interest rates of up to 8,6%. That’s significant!

Not only that, but the interest that you’ll earn is actually compounding. This is the true “kicker” in this BlockFi review.

Compound interest can seem tricky at first, but it’s actually really simple. What the term implies is simply that you will earn crypto on top of the crypto that you earn. Say, if you deposit $100 worth of cryptocurrency (or stablecoins – BlockFi accept those, too!), and earn $10 in interest, your next interest rate calculations are going to start from $110, and not $100. Put very simply, your earn on top of your earnings.

The best part of all of this is that there is no catch involved. You don’t need to lock your assets for 10 years, there are no hidden fees or contracts, and no potential scams, either – everything’s 100% legit!

As far as this BlockFi review is concerned, it would appear that BlockFi offers an amazing solution of what to do with your cryptocurrencies while they’re just idling in your wallet. It’s a way to make a passive income – make your coins work for you!

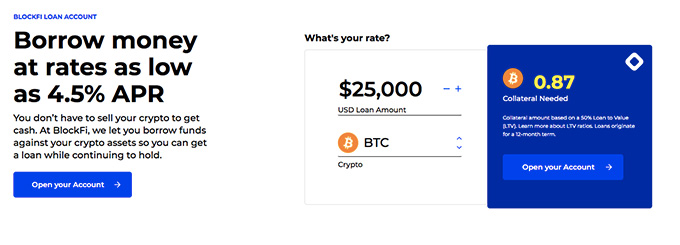

Low APR Loans

To complete the trinity of BlockFi’s main features, we need to talk about the final aspect of the platform that makes it a great choice for many cryptocurrency investors – loans. It’s also one of the main points mentioned in other user BlockFi reviews, too!

BlockFi allows you to take out cryptocurrency loans. The collateral for these loans are going to be the assets that you hold on your account – there’s no need to get your other financial assets involved!

The APR (annual percentage rate) for these loans can get as low as 4,5%. That’s actually a really low APR, when you consider those that are available with some of the more-traditional loan-granting platforms.

Truth be told, the loan aspect surely does bring BlockFi full circle! It’s an awesome feature to be had for any type of investor, since it allows you to borrow instantly, without going through some difficult and tedious processes in your local bank or credit union. As long as you have crypto in your BlockFi wallet to be used as collateral, you can take out a loan at any point in time.

User BlockFi reviews will tell you that the best part about this all is the fact that there are no penalties or drawbacks from returning your loan earlier than expected, either. You can pay it off at any given point in time – even on the same day you’ve taken it out! -, and suffer no negative consequences for doing so.

While this could be said in a whole separate chapter in of itself, the fact that BlockFi has all of these different features to offer to its users is surely a very unique point to consider! You are able to trade, and earn interest on your holdings, and even take out a loan at any given point in time, too – all on a single platform!

If anything, BlockFi is certainly setting an awesome precedent for the future of crypto technology, and raising the bar up high. Good stuff!

Easy to Use

All of the things that we’ve discussed up to this point in the BlockFi review are cool and all, but they are also not the simplest to wrap your head around, if you’re just starting out.

If you’re already an advanced cryptocurrency enthusiast, and have done your fair share of crypto trades and transactions throughout the years, I urge you to remember yourself when you were just starting out. More than likely, all of the terminology surrounding the topic was rather confusing to unwrap and put into respective places, right?

Well, for anyone getting into crypto these days, it’s arguably even more difficult. The number of crypto projects and services that are around today is mind-numbing – you can’t really expect a beginner to figure everything out by themselves, in a way that would avoid any and all potential scammers and rug-pullers!

Reading through various user BlockFi reviews, though, it would seem that the platform in question knows this quite well, too. BlockFi is reported to be very simple and straightforward to use.

The registration process (we’ll get to that) is quick and easy, and all three of the already-discussed features – trading, earning interest, and borrowing – are super-simple to start doing. The platform is streamlined and made as beginner-friendly as possible.

Evidently, if you’re aware of how to use a cryptocurrency wallet, and are able to make a transfer from one wallet address to another, you’re all set! That’s definitely much appreciated!

Regulated by and Within the United States

In the realm of finance, there’s a term called “KYC”. It abbreviates as “Know Your Customer”, and refers to a set of guidelines for financial institutions when it comes to dealing with customers and any individuals who might want to interact with said platforms.

Many cryptocurrency enthusiasts want nothing to do with KYC-friendly platforms. This is because these exchanges require you to provide personal information about yourself, and verify your identity before you can start using their services.

Granted that the whole point of cryptocurrencies is anonymity and privacy, that kind of beats the purpose, now doesn’t it?

Well, only to an extent. In order for crypto to truly go mainstream, and attract a lot of new investors (and thus, consequently, go up in price), it needs to be regulated. People are seemingly starting to understand this more and more.

On top of mainstream adoption, regulation brings something equally as important to the table – security. Regulated exchanges are going to be much more secure than KYC-free ones, since they will both have an official backing, and will be able to identify any bad actors, too.

Well, in this BlockFi review, I am glad to say that the platform in question is, in fact, officially regulated by the United States. BlockFi is located within the country, and follows all of the US-specific laws and rules. Obviously, these include those that are related to user security, and also others that have to do with, say, tax laws within the country.

In any case, the fact that BlockFi has official backing from financial security- and user protection-oriented institutions is undoubtedly reassuring. On top of that, when you compare platforms such as BlockFi VS Coinbase, it’s worth noting that the former had no ICO – there are no tokens that would be distributed, and no specific investors to please, either.

Automated Recurring Trades

This is, admittedly, an often-overlooked por of the platform in question. However, it’s worth mentioning, still, since it is truly a big benefit!

In the world of crypto, there is a term called “DCA“. It means “dollar cost average“, and refers to investing in crypto in a constant, pre-defined manner, without participating in things such as day trades or asset flipping.

With many exchanges, in order to do so, though, you’d have to visit it every select period of time (week, month, etc.), and make the purchases manually. User BlockFi reviews will tell you that this is not the case with the platform in question – it allows you to set up automatic trades.

What this means is that you can set a recurring trade order. For example, say that you DCA BTC every month, for a set amount of fiat money. Well, you can set these conditions up on BlockFi, no problem. No need to manually input the orders into the platform anymore – the exchange takes care of that for you!

It’s a great way to actively grow your portfolio, without actually needing to participate in an active manner. Definitely a noteworthy benefit of BlockFi!

BlockFi Review: CONS

So, by now, it’s rather evident that BlockFi does have a lot to offer to any cryptocurrency enthusiast that’s concerned with growing the overall value of their portfolio. That said, not all user BlockFi reviews are overwhelmingly positive – there are some drawbacks to the platform that tend to come up, as well.

Let’s take a look at these drawbacks, then, shall we?

No FDIC Asset Insurance (Gemini Insurance Might Apply)

Probably one of the biggest nightmares that a cryptocurrency holder has is the idea of logging into your wallet or exchange, and seeing that it’s completely wiped clean. All of your assets stolen or simply gone, without any way to get them back. Unfortunately, this becomes reality for quite a few crypto enthusiasts.

Naturally, there’s something that’s known as simple risk management. Best practices tell us that things such as wallet recovery code storage and avoiding clicking potentially-malicious links online can go a long way, as far as asset loss preservation is concerned.

That being said, no matter if you’re comparing BlockFi VS Coinbase, or looking for the BlockFi credit card, there’s one thing that you can’t really protect yourself against – the failure of the exchange service itself.

Now, I know what you might think – why can’t I protect myself? I’ll just simply withdraw my assets to a cold storage device, and that’s it!

While you’d be right in most other situations that concern cryptocurrency exchanges, I urge you to remember the fact that BlockFi has both a lending and an interest-accumulating service. Both of these services require you to keep your assets on the platform in question.

Now, the point here is that your assets on the platform are not insured by the FDIC. That being said, though, things might not be as bad as they seem – Winklevoss Capital is an investor in BlockFi, and the custodian service Gemini does have crypto asset insurance.

Does this insurance apply to BlockFi users? Well, finding a use case isn’t quite as simple as you might think – but that’s actually a good thing! It means that BlockFi has never had any break-in or outage-related issues.

Naturally, when you weigh the risks of something like that happening, it’s more than unlikely – that’s an agreed-upon sentiment expressed in other user BlockFi reviews, too. BlockFi employs high-end security measures, which is further enforced by Gemini.

All things considered, while there is no immediate risk that would be associated with using BlockFi (I mean, even when you compare BlockFi VS Coinbase, both platforms are on a similar level of trustworthiness), this is still something that should be kept in mind, nonetheless.

Very Limited Free Withdrawals

Remember when I said that BlockFi has no trading or hidden fees, of any kind? Well, that’s true – it doesn’t. However, what the platform DOES have are withdrawal fees.

Reading through user BlockFi reviews, you will quickly learn that there are free withdrawals available with the platform in question. However, they are super-limited – you are able to make but a single free cryptocurrency withdrawal per month, and the same applies to stablecoins, too.

Want to make more withdrawal than that? Well, tough luck – you’ll have to pay a set fee.

Now, obviously, this is a somewhat-trivial con. This is because there are plenty of high-end cryptocurrency exchanges out there that offer no free withdrawals, whatsoever – you have to pay a fee each time you make a withdrawal request.

That being said, it would still be awesome if BlockFi would increase the limit of the number of free withdrawals that you can make during the month. This, in turn, might sway potential investors towards the platform – people who would otherwise be off looking for an exchange that has a higher number of free withdrawals available on it.

Not Everyone in the Wishlist Will Receive the Credit Card

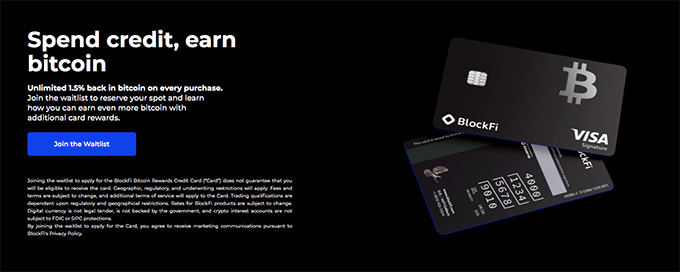

One of the more-interesting features of the platform in question is the BlockFi credit card. I didn’t mention it in the “benefit” section simply due to the fact that it still does not exist, and might be a whole different product when it does actually come out.

However, from the premise itself, it’s worth noting that it’s surely a potentially-great feature! The card will offer up to 1,5% Bitcoin cashbacks to the holder – all of which are going to be sent straight into your interest-accumulating account. This sounds like an amazing product to further the passive gains that you can make with the help of the platform in question!

Well, assuming that you’ll be able to receive the BlockFi credit card, that is. While everyone is allowed on the wishlist, the number of people that are actually able to get themselves the card is going to be limited by a few select factors.

The factors do mostly include geographical and financial zone-based restrictions, though. While BlockFi is a service that is available to be used in the majority of the world, there are areas that are not supported by the platform, and thus, won’t be able to receive the card.

It’s a bit of a bummer for anyone who isn’t aware of this, and signs up to the wishlist while residing in one of these areas. It can be really disappointing, having something to look forward to, but then finding out that you’re not able to receive it, at all!

It’s worth mentioning that, if you’re someone who’s already signed up to the BlockFi credit card wishlist, you should keep an eye out for any additional information – the company states that various additional terms and conditions might apply when the card does actually go live.

Did you know?

Compare Kucoin Side by Side With Others

All Crypto Exchanges may look similar to you but they're NOT all the same!

Yes! Show me the Comparison ChartHow to Use BlockFi?

As a final note in this BlockFi review, let’s take a look at the actual usability aspect of the platform, and how you should go about starting to use BlockFi, in the first place.

How to Register on BlockFi?

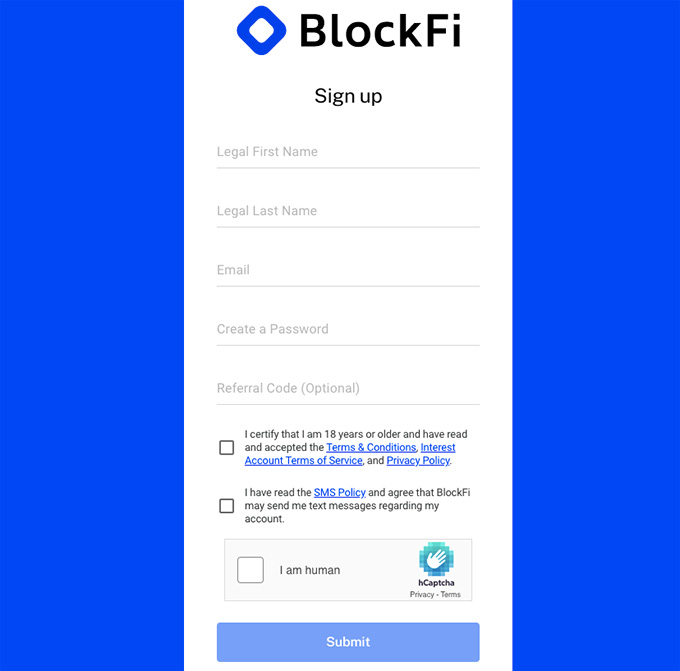

First things first – the registration process of the platform.

Step 1: Go to the BlockFi official website.

Step 2: Press the big blue “Get Started” button at the top-right corner of the screen.

Step 3: In order to sign up, you will need to enter your full name and email address, and also create a password.

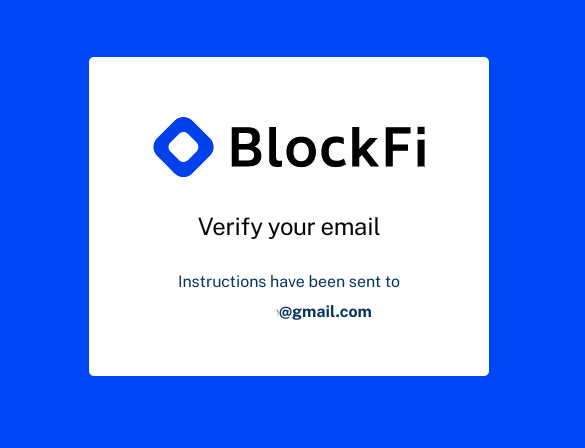

Step 4: After that, you will then be asked to confirm your email address.

Step 5: Once that’s done and dealt with, all that’s left to do is log into your newly-created account – that’s it!

After you’ve finished the initial registration process, you will then be asked to confirm your identity. The process is part of the traditional KYC verification, and it will help BlockFi determine who you are, and what sort of an investor you plan to be on the platform.

Truth be told, the registration process on the site is really quick and simple! The fact that you have to finish all of your KYC verifications straight off the bat, without even being able to access the site and check it out first isn’t ideal, though.

This is something that is echoed by some user BlockFi reviews, too. Many cryptocurrency exchange platforms, even if they do have strict KYC requirements, allow you to visit the dashboard and marketplace, and “get a feel” for what you can expect while using them.

That is, obviously, a much better approach than that which is employed by BlockFi.

Once you’re all set, and your identity is verified, you will then be redirected to the main page of the platform. Here, everything is rather self-explanatory! You can credit your account with fiat currency or crypto, and start trading and earning interest right away. Simple and straightforward!

Latest Robinhood Coupon Found:

Conclusions

With all of that being said and done, all that’s left to establish is one, single thing – is BlockFi a platform that’s worth checking out and using, or should you avoid it, altogether?

Well, I think the answer is rather obvious, if you’ve read this BlockFi review up to this point – yes, it’s worth using!

BlockFi is one of the more-interesting crypto projects on the current market – that goes without saying. It combines three major financial services – trading, lending, and interest accumulation – into a single platform, and allows them to interact with one another.

BlockFi is also completely transparent – the company is based in the United States, and regulated to the fullest extent. This does result in aggressive KYC verifications right after you sign up, but at the same time, it guarantees that there’s no foul play involved with the platform.

In general, the service is simple to use, has some amazing offers in regards to BlockFi interest rates and loans, and is trusted by many cryptocurrency investors all around the world. While the selection of cryptos available on the platform is, admittedly, rather scarce, BlockFi isn’t necessarily primarily an exchange, so that doesn’t seem too big of an issue.

The only thing that’s worth keeping in mind, however, is that there are no guarantees for the safety and security of your assets – if something were to happen with BlockFi, and your cryptocurrencies and stablecoins suddenly vanished, you would probably be unsuccessful in finding a solution of how to get them back.

If this is something that you can’t overcome, and would thus like to use an alternative exchange platform, do check out our list of the best crypto exchanges and brokerages on the market! Who knows – perhaps the best tool for trading crypto is waiting for you there?

All in all, I hope that this BlockFi review was useful to you! Thanks for reading, and good luck!

The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. CoinCheese.com does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency. Before making financial investment decisions, do consult your financial advisor.