When is the BEST time to buy crypto?

Category: Blog

A problem all crypto traders are facing: when to buy crypto at minimized cost?

Cryptocurrencies like Bitcoin can experience big daily price volatility. As with any kind of investment, volatility may cause uncertainty, fear of missing out, or fear of participating at all. When prices are fluctuating, how do you know when to buy crypto?

Theoretically, it’s simple: buy low, sell high. In practice, this is easier said than done, even for experts. It is really hard to choose a time to buy crypto, especially during this highly volatile market. When you miss ETH 7-day-low, you may also regret not buying ETH, and vice versa.

Instead of trying to “time the market,” many investors use a strategy called dollar-cost averaging (or “DCA”) to reduce the impact of market volatility by investing a smaller amount into an asset — like crypto, stocks, or gold — on a regular schedule.

DCA might be the right choice when someone believes their investments will appreciate (or increase in value) in the long term and experience price volatility on the way there.

What is DCA strategy?

DCA is a long-term strategy, where an investor regularly buys smaller amounts of an asset over a period of time, no matter the price (for example, investing $100 in Bitcoin every month for a year, instead of $1,200 at once). You can decide your own DCA schedule, it can be daily, weekly, or monthly.

The basic principle of DCA is to invest a certain amount regularly. For example, Ben’s DCA schedule is to buy $50 worth of Bitcoin every week. In this case, Ben invests $50*52=$2600 in total per year. But remember, DCA needs to be done regularly instead of a lump sum, which means investing $2600 in one shot is much different from the DCA schedule.

Although DCA is a popular way to buy Bitcoin, it isn’t unique to crypto — traditional investors have been using this strategy for decades to weather stock market volatility. You may even use DCA already if you invest via your employer’s retirement plan every payday.

What are the benefits of DCA?

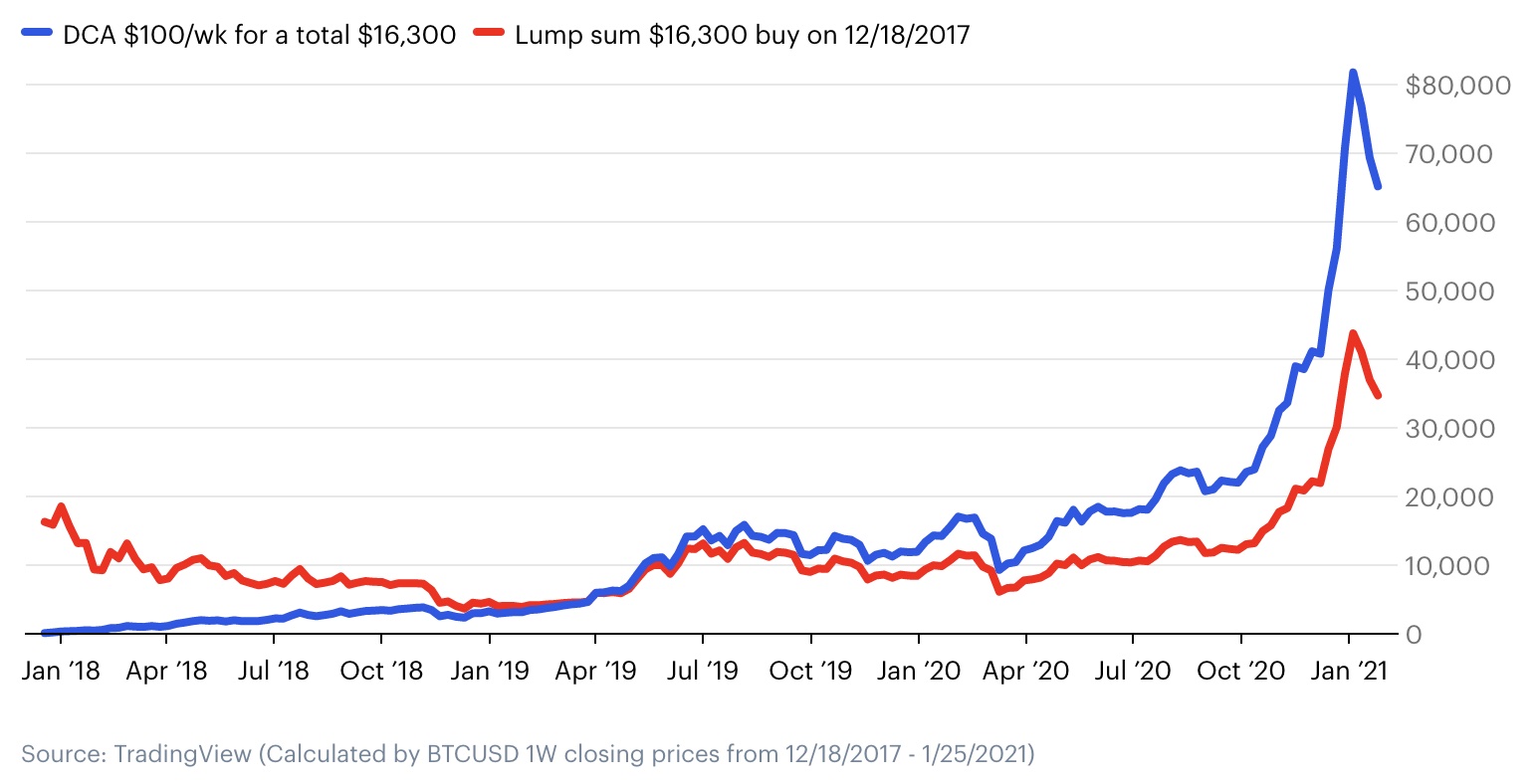

DCA can be an effective way to own crypto without the notoriously difficult work of timing the market or the risk of unwittingly using all of your funds to invest “a lump sum” at a peak.

For example, if you earn $1000 per week, you might be comfortable investing $50 into BTC. Investing $50 won’t hurt you much even if BTC drops by 10% (equivalent to $5 only).

The key is choosing an amount that’s affordable and investing regularly, no matter the price of an asset. This has the potential to “average” out the cost of purchases over time and reduce the overall impact of a sudden drop in prices on any given purchase. And if prices do fall, DCA investors can continue to buy, as scheduled, with the potential to earn returns as prices recover.

When is DCA more effective than lump-sum in crypto?

DCA can help an investor safely enter a market, start benefiting from long-term price appreciation, and average out the risk of downward price movements in the short term. And in situations like the ones below, it may offer more predictable returns than investing a lot of cash at once:

-

Buying an asset that may increase in value over time. If an investor thinks prices are about to go down — but are likely to recover in the long term — they can use DCA to invest cash over the period of time they think a downward movement will happen. If they’re right, they’ll benefit from picking up assets at a lower price. But even if they’re wrong, they’ll have investments in the market as the price increases.

-

Hedging bets through volatility. DCA exposes investors to prices across time. When a market experiences price volatility, the goal of this strategy is to average out any dramatic increases or decreases in their portfolio and to benefit a little bit from price movement in every direction.

-

Avoiding FOMO and emotional trading. DCA is a rule-based approach to investing. Often, beginner traders fall into the trap of “emotional trading”, where buying and selling decisions are dictated by psychological factors like fear or excitement. These can lead investors to manage their portfolios ineffectively (think: panic selling during a downturn or overbetting due to fear of missing out on exponential growth).

BTC dollar-cost average vs. lump sum

Conclusion

Dollar-cost averaging is all about hedging your bets: it restricts your potential upside in an effort to mitigate possible losses. Serving as a potentially safer choice for investors, it works to reduce your chances of taking serious hits to your portfolio caused by short-term price volatility.